For most investors, 2022 is one of those years they’ll be happy to see in the rear view mirror. But, with the Fed still putting the brakes on the economy by way of higher interest rates, the outlook for 2023 isn’t looking much better. Conditions being what they are many investors are left wondering if they should continue to hang on and wait as their accounts decline in value, or if there might be a better option.

With the stock market down nearly 20% as of today, it’s no surprise that investors are concerned. The sage advice that all one has to do is buy a couple of index funds, and hang on for the ride, offers little consolation during a down market. And, while it’s true that the market always comes back, the recovery can sometimes take an awfully long time ̶ years in fact, depending on how far it’s fallen.

Like most people, I used to follow the advice of the supposed experts and doggedly hung on as my retirement accounts imploded. Case in point, when the dot-com bubble burst I lost over 50% in my 401k. Later, I watched the same thing happen again when my IRA fell nearly 40% following the housing market collapse. But, with the experts saying the stock market always comes back I continued to hang on.

Suffice it to say, for most of my years of saving and investing I was a staunch proponent of buying a fund that tracked the passive S&P 500 index and never selling. But, that started to change back in 2013 when it occurred to me that perhaps much of the S&P 500 index’s growth might be due to everyone following the same advice. I knew from simple economics that when a lot of people are buying the same item it drives the price up. This got me thinking that with everyone buying S&P 500 index funds just like we’ve been told to do maybe that was one of the main drivers behind its meteoric growth in recent years. The realization that the stock market rising might be due in part to a self-fulfilling prophecy had me wondering what would happen if everyone got nervous and started selling at the same time. Could all those folks simultaneously selling result in prices declining even farther than was justified? Basic economics said it could.

For a time, I’d been including dividend companies as a means to generate more income for several retired clients when I began to notice that on days when the stock market was declining the dividend companies seemed to fare better, generally falling far less than the low-cost S&P 500 index fund I was using as the foundation in all of my client’s portfolios. It had me wondering how a portfolio comprised solely of dividend companies might perform against the index. Finally, in the spring of 2019, I sold all of the funds in my IRA and built a portfolio comprised solely of dividend companies. I then began to monitor the movement of the dozen or so companies against the S&P 500 index.

As I waited to see what would happen, I decided to work on a screening tool for selecting dividend companies. I knew if my portfolio of dividend companies performed as I expected it would, I’d have no choice but to introduce the concept to the public. As a starting point, I considered the companies in the S&P 500 Index. I knew that the S&P 500 Index is a collection of the 500+/- largest U.S. companies and that when buying an S&P 500 index fund, the investor is simply acquiring portions of all of the companies represented by the index. But, aside from the more obvious companies like Google and Amazon, I really knew little about most of the other companies in the index. I decided to take an in-depth look. What stood out almost immediately was just how lopsided the index is.

According to Fidelity Investments, the U.S. economy can be broken down into 11 areas, or sectors. These sectors when viewed like slices of a pizza come in various sizes. The reason for this is two-fold. First, the sectors are comprised of different numbers of companies. Second, those companies come in all sizes. So, here’s a juicy little tidbit that most investors are unaware of. The S&P 500 index is a cap-weighted index. “Cap”, or capitalization, refers to the size of a company. The larger a company’s size (capitalization), the larger it’s representation (weighting) in the index. The implications of this are that the largest companies in the S&P 500 index have a significant impact on its return while the smallest have almost no impact. And, that’s just for starters. Further compounding the situation is that several of the largest companies in the index come from the same few sectors. This concentration in both size and sector had me thinking that S&P 500 index funds aren’t nearly as diversified as I’d been led to believe. I suspected this condition meant that only a few companies and sectors might be responsible for most of the indexes long-term return. See below for breakdown as of 5/6/22.

Additionally, remember how when everyone is buying the same thing it drives up the price? Well, many of the biggest companies are that way for a reason. Those that sell the hottest products, like Apple Inc. for instance are among the most popular which means nearly everyone buys their products. And, since everyone is buying their products, investors too pile onto the bandwagon buying up shares of the company and driving up the price. I concluded that popularity is largely responsible for the compounded size and thus the over-sized representation of certain companies in the S&P 500 index. And, then there’s another contributing factor. In addition to the passive index fund managers who are compelled to buy their shares, both active fund managers and individual investors alike are also buying the shares of those companies and further driving up the price.

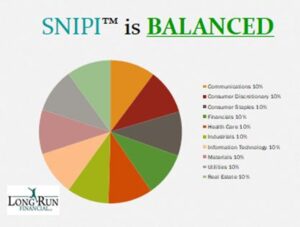

My theory about popularity leading to outsized company growth and sector size led me to consider what would happen if a few of those companies fell out of favor whether due to a misstep on management’s part or even as a result of a normal stock market pullback. I suspected just as their oversized weightings were responsible for magnifying the returns of the S&P 500 index when it was going up, those same inflated weightings would exaggerate negative index returns during stock market pullbacks. It was then I came up with the radical question of what might happen if I assembled a blended portfolio of (mostly) lesser known companies and gave equal representation to each of the economic sectors.

I’d already seen how individual dividend companies performed on a day-to-day basis and was curious to know how a market-neutral portfolio would perform against the S&P 500 index. Surely, it would experience lower price swings. If so, how would it impact a portfolio’s returns over time?

In creating this market-neutral portfolio I decided to limit the selection of companies to those that pay dividends. My purpose for doing this was to enhance the income being produced by the portfolio, and additionally to reduce my own bias for certain sectors or the popular growth companies found in the S&P 500 index. As I set about researching companies and fine-tuning the portfolio through back-testing I decided to take the radical step of excluding all companies from the energy sector. See breakdown below.

The reason for the removal of energy is that from a historic standpoint, the energy sector appears bipolar and generates a wide dispersion of annual returns. As I expected the removal of the energy sector did indeed result in a significant dampening of portfolio volatility and subsequently this caused it to produce more consistent returns. What I hadn’t anticipated was just how much that lower volatility might enhance the return of the portfolio.

Fast forward to the present and the results are speaking for themselves. Since, creating that first all dividend company portfolio, I’ve transitioned all but the very smallest of my client’s accounts to this form of investing. Not only that, I’ve developed a stock screening formula that has reduced the universe of companies to a field of less than two hundred qualified candidates. I’m hesitant to share all the ingredients of my recipe, but let’s just say Sector Neutral Income Portfolio Investing or SNIPI™ as I’ve named the process generates returns consistent with what my testing had shown.

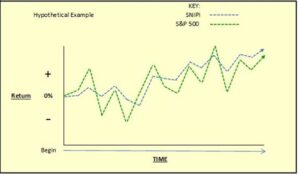

The importance of SNIPI™ neutrality cannot be overstated. That’s because with each stock market pullback SNIPI™ falls far less than the S&P 500 Index.

The result is a portfolio which remains in a much stronger position than the S&P 500 Index each time the stock market starts to rise again. The implications are SNIPI™ more readily regains what was lost and returns to a positive return more quickly than the S&P 500 index. The lower decline and more rapid recovery each time means that SNIPI™ doesn’t need to produce those outsized gains required by investors that rely on the return of the S&P 500 index. And, because the trend is repeated with each market cycle, subsequent downturns cause the SNIPI™ lead to increase still further resulting in a higher average annual return despite not always beating the market over shorter periods of time.

Happy Investing,

Dennis Gravitt AFC® CFP®

Tune in next month to see the actual 2022 SNIPI™ returns experienced by my clients